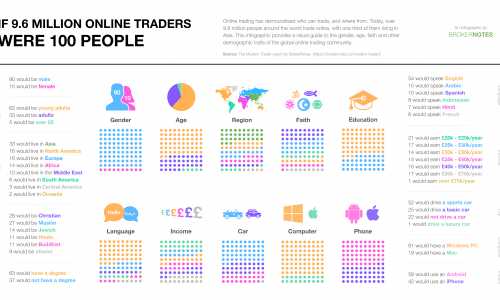

Stocks, bonds, commodities -you’ve probably heard from CNBC or a financial advisor that you should be investing in these types of assets. The general strategy is to buy low and sell high, making money on the price appreciation. If you’re part of the online trading community, figuring out market moves is part of your bread and butter strategy.

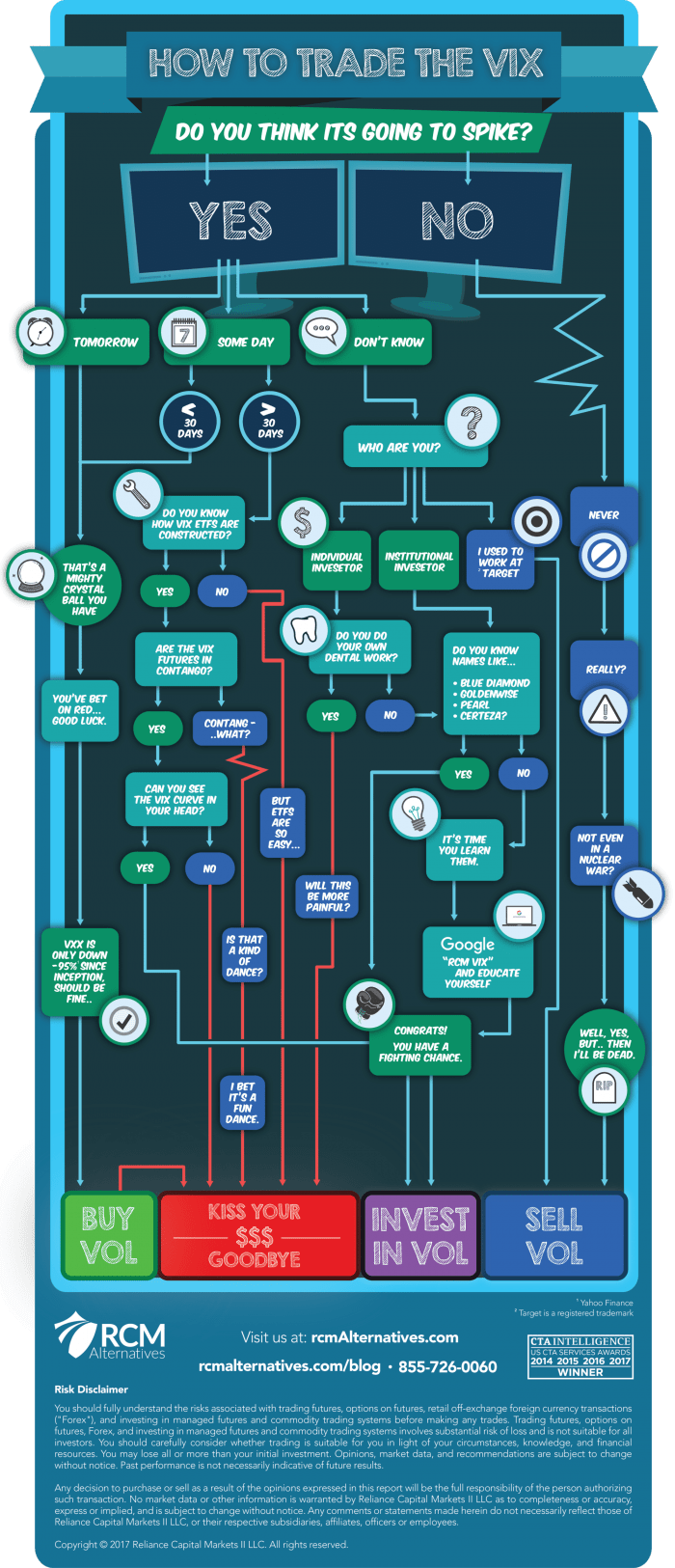

It might surprise you to find that there’s an entire market dedicated to trading on how quickly asset prices move, or in other words, their volatility. A popular index to monitor is the VIX, an index commonly known as a “fear gauge”, because it is based on how fast the S&P 500 Index fluctuates.

How do you make money from price volatility? You’re also trying to buy low and sell high, but that means buying volatility when the market is dull and range bound, then selling after there have been wild swings that you don’t think will continue.

This derivative market is not for the faint of heart , but it could also be a way to protect yourself when you think the market is headed for highly volatile moves.

Typically you would expect the market to be volatile when there are market crashes, while bull or rising markets bring falling volatility. That’s why when the stock market is high, generally the VIX trades around low levels, as it has been lately. A former Target manager made his fortune selling volatility, which this infographic references tongue in cheek(and is surely not investment advice).

Also, trick title, you can’t directly buy and sell the VIX, but there are plenty of ways to bet on whether the VIX will rise or fall. For more information check out RCM’s tutorials.