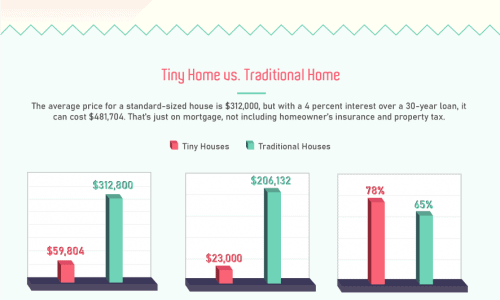

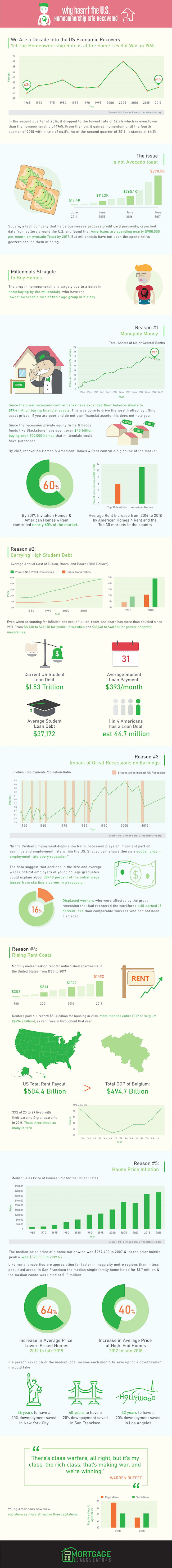

The American dream used to be predicated upon several social rites of passage: a big wedding with a poofy white dress, 2.4 children, and most importantly, buying a big suburban house with a white picket fence.

Lately, however, rates of homeownership have dropped, and even as they start to recover, they haven’t yet reached their previous levels. To explain why, there’s many factors to consider.

Fundamentally, the issue is that millennials aren’t buying homes. There’s a variety of causes, such as millennials spending more disposable income on food or travel, failing to keep to a budget, or preferring the flexibility of renting. But ultimately, millennials simply cannot afford homes, due to stagnating salaries and skyrocketing housing costs.

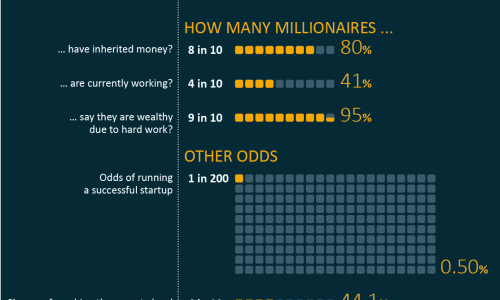

Interestingly, one culprit is actually a different form of homeowner: big financial institutions. Increasingly, since the financial crisis, private equity firms and hedge funds have spent over $40 billion buying over 200,000 homes, taking properties that could otherwise be bought by millennials.

Student debt is another stumbling block to millennial home ownership, as the cost of tuition and room and board has doubled at American universities since 1971- even when inflation is taken into account. As a result, young people are burdened with debt and spend longer paying it off, instead of purchasing a home. Perhaps in time, incomes will rise and home ownership rates will be restored- but this generation may miss out.