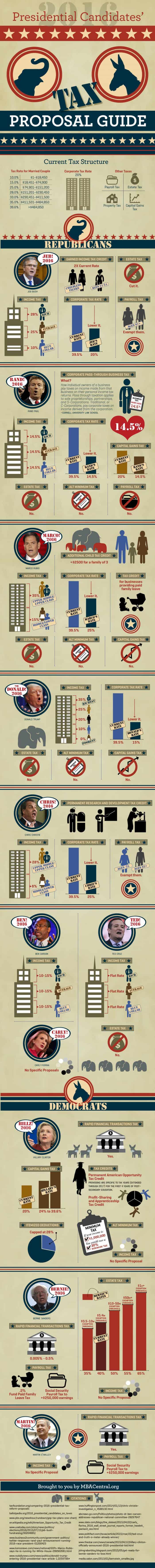

Today’s graphic offers a complete guide to where each presidential candidate stands on their proposals to change our tax structure. Many of the republicans are looking into a flat tax that would tax any income the same percentage. Some, like Donald Trump, would keep our tax rates similar to what they are, but lower corporate tax rates to the lowest of his competitors.

Hillary Clinton proposes a possible steep increase in the capital gains tax. Her idea on giving tax credits to companies who offer profit-sharing, or apprenticeships is very interesting.

Bernie Sanders wants to hike the estate tax for the extremely wealthy. I don’t plan on making a billion dollars anytime soon, so this one is in my favor. He also wants to impose a very small rapid financial transactions tax. This could lead to big money with how easy it is to transfer money digitally. This could lead to a rise in cryptocurrency popularity in order to skirt the tax.